Soylent Eater Survey – The Results are in!

Over the past two months, a large-scale survey investigating the new modern drinkable meal market was performed. The results are incredibly interesting for consumers, companies, and the media alike.

Just like last year, the survey was an international cooperation between various companies in the industry, spearheaded by KetoSoy (KetoSoy.com). The largest of which are Rosa Labs (Soylent.com) in the US, and Queal (Queal.eu) in Europe.

Highlights

- 71% of respondents report eating 1-2 meals a day from soylent/future food, only 2% completely replace all meals.

- The market has more than tripled in the past year, now a €70-100mn market serving an estimated 1 million people a year. Potential market estimated at over €6bn

- Ready to drink is in, Bars are on the way, powder mix is still going strong, and the one-day bag of powder is on its way out.

General information on the survey

This year 3158 respondents filled in the survey. That’s a five-fold increase over last year. Calls for participants were sent out over Reddit, Discourse, as well as through the customer lists of several drinkable meal producers in both the US and EU. The call out from specific producers wasn’t sent out until halfway through the survey’s lifetime, to gather plenty of unbiased brand-aware data.

No dystopian future in sight

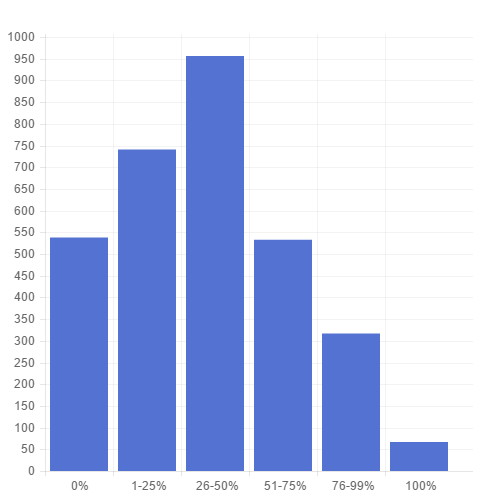

Graph 1: What % of daily calories is derived from drinkable meals?

Graph 1: What % of daily calories is derived from drinkable meals?

Only 2,1% of respondents said they were living off of nothing but drinkable meals. This shows that the early reports of Soylent and soylent-like products fully replacing all food in the near future, were grossly exaggerated. Most people tend to use Queal and similar products to replace one or two meals a day, mostly breakfast and lunch.

The data also shows that in general people don’t seem to have any major need or drive to stick to a strict diet of drinkable meals. When the occasion arises for social meals, people join in normally. A lot of the respondents also mentioned not having any issues with “feeling guilty” about eating specific foods.

The average drinker

The vast majority of people consuming drinkable meals is male. A mere 18% of respondents was female. Although this gender gap closed somewhat compared to last year (up from 14%), it is still a massive and strange incongruity, for which we don’t have a real explanation.

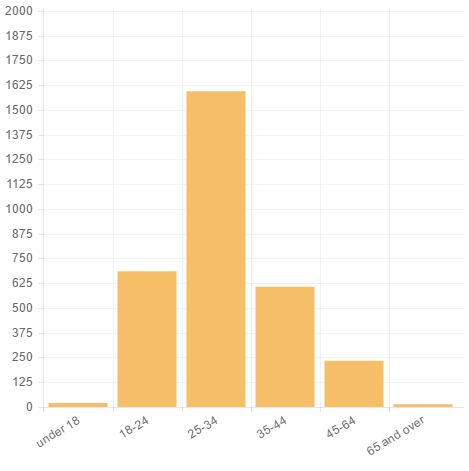

Graph 2: How old are the consumers of drinkable meals?

Graph 2: How old are the consumers of drinkable meals?

50% of respondents is between 25 and 34 years old, with a further 22% between 18 and 24, and 19% between 35 and 44 years of age. This is likely a function of the consumers having a need for a quick meal during their busy (professional) lives.

How drinkable meals improve lives

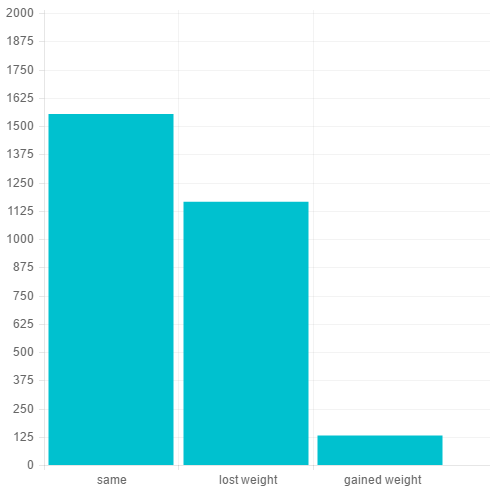

Queal and other modern drinkable meals are often equated with liquid diets designed specifically for weight loss. Although most could be used for this means, it is not often the goal. We don’t have data on the intention of the respondents, but 55% mentioned staying at approximately the same weight. 41% reported weight loss. This is a slight shift towards weight loss from last year (33%). Perhaps with the product becoming increasingly mainstream, people are discovering it as a non-extreme version of calorie intake control.

Graph 3: Weight changes on a drinkable meal diet

Graph 3: Weight changes on a drinkable meal diet

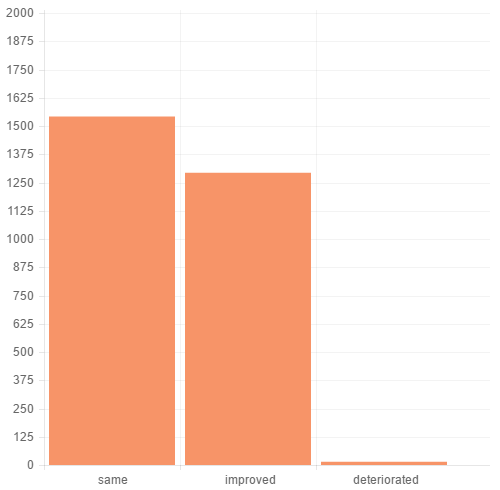

We also gathered self-reported (subjective) health changes. A massive 45% of people reported feeling that their health had improved since they started using drinkable meals. Further research needs to be performed to back this up with actual medical data of course, though anecdotal evidence in the form of multiple Queal customers running extensive blood tests do tend to show across-the-board improvements on vitamin-, mineral-, and cholesterol levels.

Graph 4: Health changes on a drinkable meal diet

Graph 4: Health changes on a drinkable meal diet

Soylent (Rosa Labs) is massively losing ground

Where last year the $20+ million dollar company had nearly 100% market brand awareness, this has dropped down to below 90%. Furthermore, only 69% of respondents said their primary drinkable meal provider was Soylent (either powder or ready-to-drink). Other drinkable meal distributors, like Queal or KetoSoy, have been slowly siphoning off their own piece of the pie. Especially in Europe, where Soylent is as of yet difficult to attain, competitors are gaining ground.

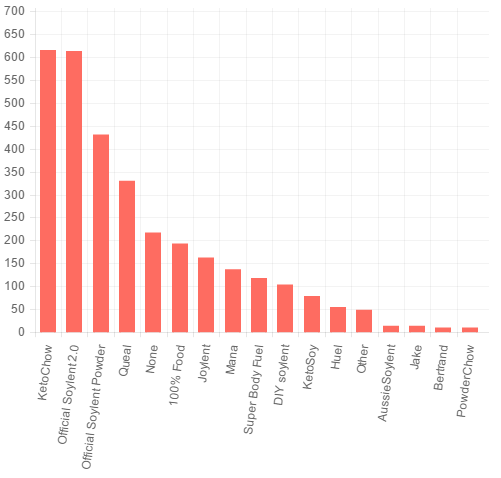

Graph 5: Heard of brands

Graph 5: Heard of brands

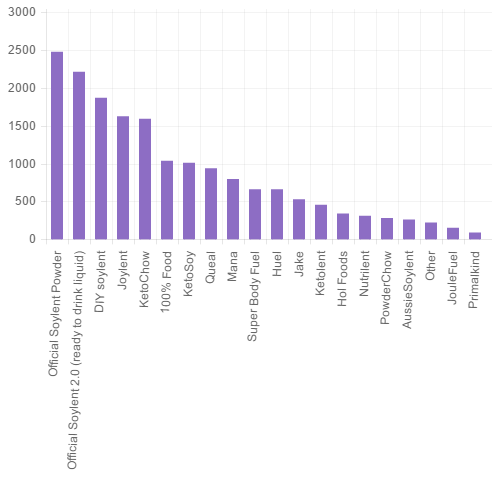

Graph 6: Brand primarily consumed (biased in favour of brands that sent out the survey)

Graph 6: Brand primarily consumed (biased in favour of brands that sent out the survey)

Market now at €70-100mn per year, over 3x what it was last year

Ketosoy extrapolated information from their numbers, estimated the orders from other producers and used publicly available numbers when possible to estimate the market size. The market has more than tripled in the last year when it was estimated at €27mn. This means that about 200,000 people now have a drinkable meal as a staple meal in their diet. Between 600,000-1,000,000 people have tried it in the past year.

This means that about 200,000 people now have a drinkable meal as a staple meal in their diet. Between 600,000-1,000,000 people have tried it in the past year.

When we look into the future the market becomes even bigger. Because the drinkable meals (and complete food replacements in general) are suitable for almost anyone, stickiness and adoption are the two most important metrics. The potential market is estimated at over €6 billion. At this moment, we only just arrived at the early adopter stage in the product market-cycle.

Read more about the survey at KetoSoy’s blog.

This is where Queal stands

In a massively growing industry (which has transformed the lives of many) we’re making a significant impact. Although not the biggest (yet) we help to add diversity to the product offering and are always on the forefront of innovation with recipe and flavours. Let’s continue growing in the coming years!

Thank you all for participating in the survey!

For media info about Queal please visit our media page!

Do you recognize your own usage patterns that the averages above show? Sound off in the comments below.

Join our list and receive an information ebook for free.

No Comments